“Don't tell me what you think, tell me what you have in your portfolio.”

- Nassim Nicholas Taleb

Talking about money is super important. Making it a regular topic with friends, family, and especially your partner is the best way to learn, have it work for you, and bullet-proof your future by starting early.

The best way to cut through noise is to ask, “What’s in your portfolio?”

What’s in my portfolio?

** Note: Keep in mind, I’m pretty restricted (can’t invest in individual stocks, ETFs, crypto, etc.) given my work. This has been a huge blessing because I’m undistracted by missed opportunities to (likely) underperform the market

70% U.S. Large-Cap Growth: FSPGX, SWLGX

Think about this like a subset of NASDAQ (tech and internet-focused U.S. companies)

There’s no difference between FSPGX and SWLGX, one is just Fidelity (free to trade on Fidelity), and the other is Schwab (free to trade on Schwab)

My favorite part about this mutual fund is that it has a 0.04% expense ratio, and most NASDAQ funds are 0.25-0.50%

20% S&P 500: FXAIX, SWPPX

This is a way to own 500 companies through one investment, specifically, the 500 largest U.S. companies

Again, no difference between FXAIX and SWPPX (Fidelity vs. Schwab versions of the same thing)

Expense ratio, 0.02%

5% Semiconductors: FSELX

With a small percentage of your portfolio, it’s ok to swing for the fences / try your capital at a specific thesis

Keep in mind, thematic or geo-specific funds will cost you more in fees; the reasoning being that it requires more active management for the fund to provide

In my case, 25% of this fund is in NVIDIA, and given I’m restricted from single-stock investing, it is the closest I can get via a mutual fund

Expense ratio, 0.65%

5% China: FHKCX

Similar to the above, this is a small contrarian bet, in some ways as a hedge to my largely U.S. exposure

Don’t overlook overlaps in your allocation. For example, TSMC is 25% of this fund, but also 7% of FSELX above

Expense ratio, 0.91%

Net worth allocation:

The above comprises the majority of my savings, circa 55%

(+) Some of my compensation is in carried interest, profit sharing, and co-invest; those dollars that are “in the market”, another 33%

(+) Retirement accounts (401K, HSA, Roth IRA), another 7%

(=) 95% of my liquid net worth is “in the market”

The remaining 5% is cash (3%), bonds (1%), and some angel investments (donations? 1%)

Mistakes I made:

Trying to beat the market: For years, before I was as restricted in my trading, I tried niche contrarian value investing, speculative stock-picking, and buying things I knew nothing about (crypto), instead of investing in S&P and NASDAQ. I underperformed the market every year, for five years

Not engaging auto-pilot: Every month, I would manually transfer dollars to a brokerage account, watch the market 5 hours a day trying to find the perfect time to invest it, and agonize over every dollar-cost-average decision. I missed big market upswings by not automating withdrawals and reinvestments, and wasted a ton of time which just hurt my returns

Not paying attention to fees: Independent of investment performance, even a 0.50-1% fee (I know, sounds small), is a huge annual drag on your portfolio. Especially in retirement accounts like 401Ks and IRAs, some funds (target date funds, specialized size or geo funds, income generating bond funds, etc.) charge insanely high fees that eat away at your account every year. Pay the absolute minimum in fees, don’t hire a financial advisor, and automate index investing

Panicking and taking profit / covering losses: Even with money I am investing for the long term, I would panic sell secular winners during bad drawdowns (when really, these were great opportunities to buy more = average down). Two mind tricks that work on me: (i) If someone offers you a random price everyday for your house, why do you care / pay attention? (ii) If you liked it at $100, shouldn’t you like it more at $50?

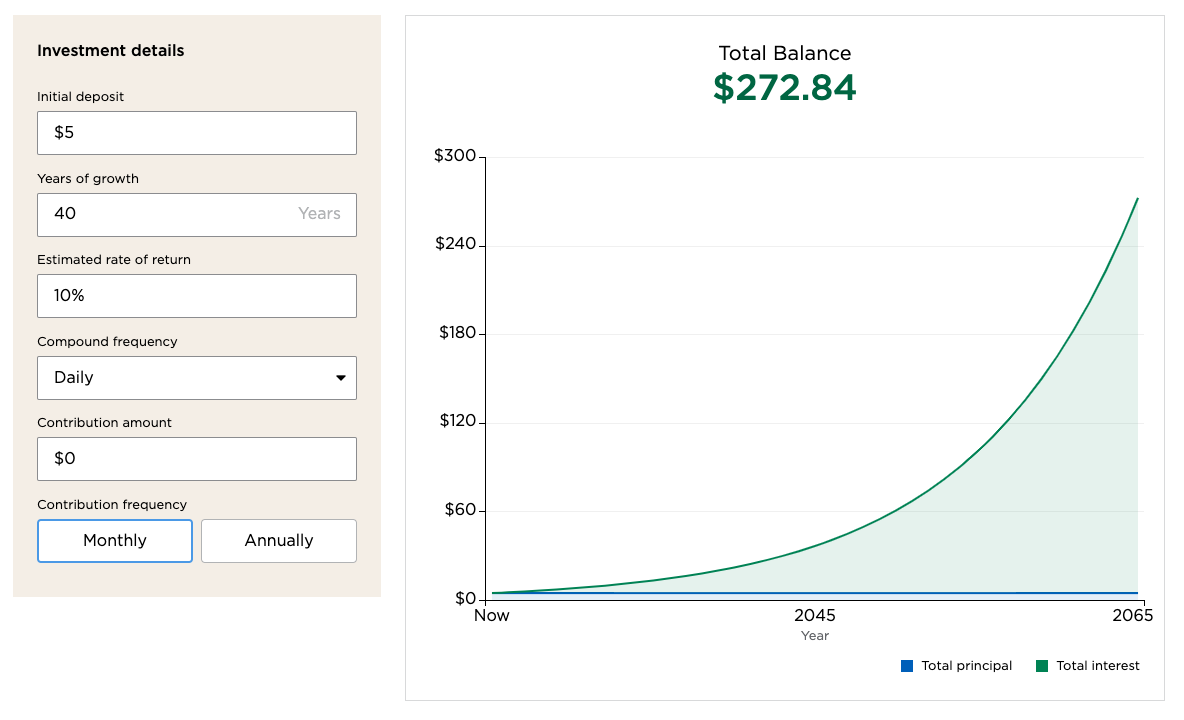

Spending first, investing second: It’s easy in your 20s to benchmark yourself to your co-workers, friends, and spend more as you earn more. Find a mind trick that forces you to cut habitual or mindless spend. For example, is your coffee really $5, or is it $270? When you get paid, invest first » then save » then spend

What I learned:

** Note: Not advice, I’m also just figuring this out

Outfoxing the market is hard

Put saving and investing on auto-pilot

Don’t pay fees to people who care less about your money than you do

Be anti-niche and long-term (buy the indices, ride the volatility and go long)

Grow your chip stack